Temporary house insurance means you can get cover when you need it most without having to consider the longer term.

At Emerald Life we know that sometimes we all need flexibility. That’s we we offer a very flexible annual home policy, cancellable at any time so that – provided you have not made a claim – you will get a pro-rata refund with no admin fee. That means if you no longer need your home insurance after three months, you can get 9 months’ worth of your premium back. What’s more is our pro-rata refund is calculated on a daily basis – meaning you don’t pay for an extra month if you cancel at the start of the month. But, just to repeat, the only condition is that we cannot refund any policy that has had a claim.

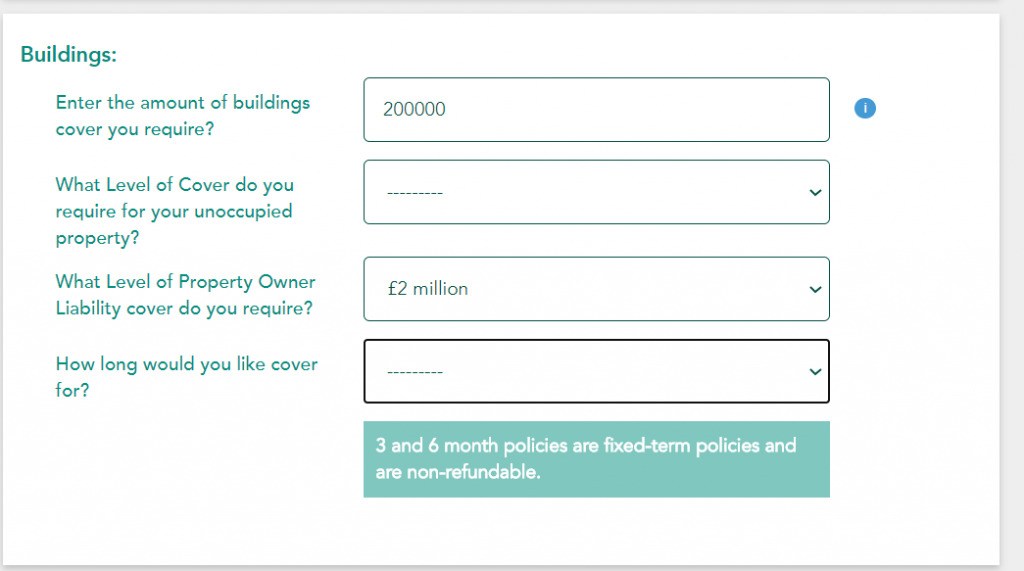

If you are looking for unoccupied house insurance – such as for probate – then we offer the same pro-rata refund on 12 month policies or can offer policy terms of three months or six months, but those are fixed term cover.

Of course if you are looking for temporary house insurance a big question has to be why. The same risks and perils that home insurance guards against are rarely reserved to a small time frame. If you have to get temporary house insurance for a specific purpose then you may want to consider keeping the policy active.

Selling a property is a common reason for people to look for temporary house insurance. In that case it is easy to get a 12 month policy and then cancel when the sale completes for a pro-rata refund.

Unoccupied Properties

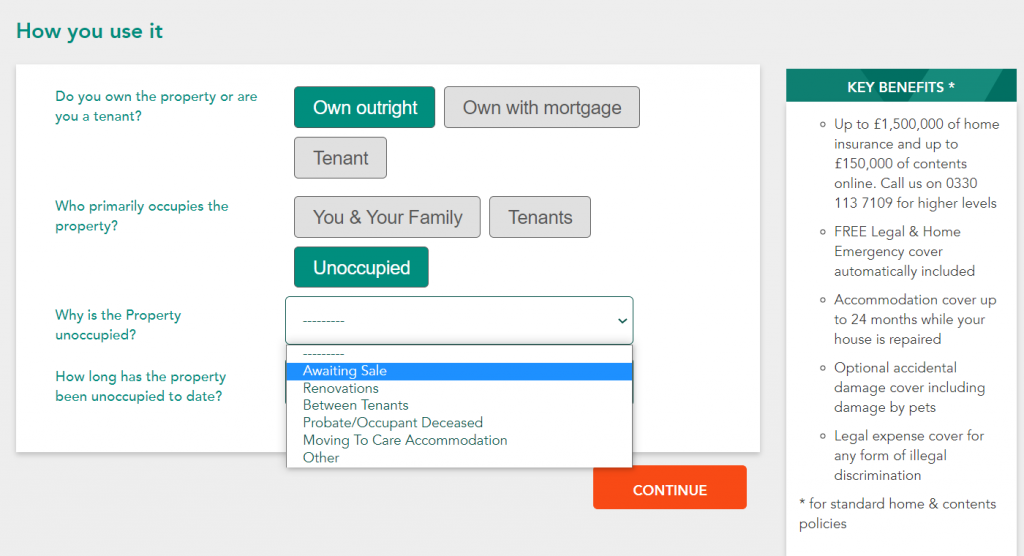

Most of the common needs for temporary house insurance generally mean the property is unoccupied. For example:

- You’re going away travelling

- The house is waiting to be sold and you have moved out

- You are expecting renovations

- Probate or the owner going into long-term care

- Gaps between tenants on a rental property

In these cases not only does your house insurance need to be temporary – yet flexible – but your policy also needs to cover unoccupied properties.

Most standard home insurance policies have a limit of 30 consecutive days for the house to be unoccupied. Beyond this point a property is judged to be at higher risk of damage and so an insurer is likely to turn down a claim where a property covered by standard home cover has been unoccupied for more than 30 days.

It is therefore important to disclose the length of time your property will be unoccupied to your insurer – we make that easy through our fast online quote form. That way they can charge appropriately and give you cover for properties unoccupied for more than 30 days.

How To Get Temporary House Insurance?

With Emerald Life it is easy to get temporary home insurance depending on your situation.

If you are occupying the property in question then you can simply go through our fast online quote form. When you’re ready to cancel just let us now by phone or email to receive a pro-rata refund providing you have not claimed.

If the property is unoccupied then you can still get a quote online. Simply select “unoccupied” when asked. You can then choose the policy term you would like. Note that we cannot offer pro-rata refunds on three and six month policies.

If you have any questions do not hesitate to let us know by email or phone.

Renovations

If you need short term home insurance for property renovations then you can get a quote online if the renovations will cost less than £25,000.

Above this limit there is a good chance we can still cover you but you need to speak to us.

Once we can establish the work involved we’ll refer your case to our underwriters who will give us further instructions about your cover.

Usually we can arrange cover to start when your renovations start, providing you have provided any documentation we request.

This can be useful if your current home insurer does not offer renovations insurance and says you must look elsewhere for the period when the work will be undertaken.

Again renovations insurance policies if the property is unoccupied can be bought on a fixed 3 or 6 month term with no pre-rata refund available or a 12 month term which does have a pro-rata refund option (and the 12-month also applies to properties that you continue to live in).

Article: Temporary House Insurance