Life can be tough as a landlord. But it can be even tougher on housing benefit. You may feel like you’re giving a helping hand to someone in need when you take on a DSS tenant, especially as you are no doubt swamped by applications from potential DSS tenants.

And your reward – a more complex insurance situation?

Thankfully DSS landlord insurance doesn’t need to be that difficult.

At Emerald Life we offer landlord insurance for DSS tenants that includes all the benefits on our landlord insurance for any other type of tenant.

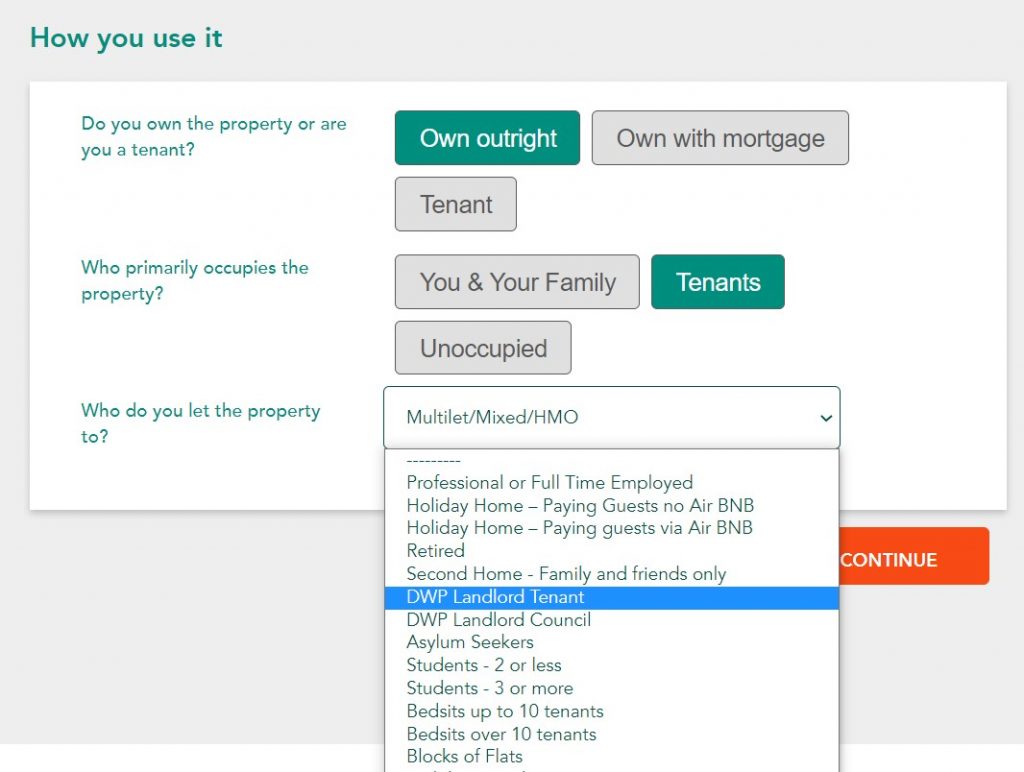

Simply visit our fast online quote form and select the options most relevant to you. If you have any questions then feel free to email or call us.

That includes cover such as lost rent if the property is made uninhabitable and £5000 of landlord contents cover provided free. We are also able to provide cover for houses of multiple occupation (HMO insurance) including DSS tenants.

In fact, the whole term of DSS landlord insurance is outdated. The term refers to the old Department of Social Security, who oversaw benefits payments before it was replaced by the Department for Work and Pensions back in 2001. Now housing benefit is called the Local Housing Allowance (LHA), but DSS is still common terminology in real estate.

However, you should still inform your insurer if you have DSS tenants. A lot of landlord insurance applications will ask about tenant benefit claims and it is important that you answer truthfully as with any other question. And many insurers may not cover DSS tenants at all, so if you are changing the type of tenant that you have, then you will need to let your insurer know – as you should with any material change in your factual circumstances.

Table of Contents

What is Landlord Insurance For DSS Tenants?

Insurers want to know details of your tenant to help get an idea of the risk level of your property. Just as loads of other data points such as flood risk, crime rate and other internal and external factors can affect the premium you pay, so do your tenants’ employment situation and benefit claims. Bear in mind that you might also have to answer questions on the credit history, bankruptcies and criminal convictions of those living at the property.

While anyone can fall on hard times, many insurers see tenants on housing benefit as being higher risk. This is generally more the case for rent protection insurance because DSS tenants may be more likely to default.

Whether right or wrong, a lot of insurers also believe DSS tenants are more likely to cause malicious damage and steal landlord contents.

Landlord insurance policies can be very different in terms of what they cover so it is worth shopping around.

For instance, rent guarantee insurance can be quite complicated with many insurers requiring specific terms and conditions to be met. As many landlords have discovered during the COVID crisis, rent protection cover is rarely a blank cheque, so it is worth reading the details of any rent protection that is on offer to see if it is, in fact, value for money.

Similarly you should check if a policy covers losses and damage caused by the tenants themselves as this could be an exclusion of the policy. It is arguably the exclusions you should be checking more than what is covered.

Landlord Public Liability Insurance

An important part of any buildings insurance policy is public liability insurance. That means if someone is injured by your property or has their own property damaged by it then you have cover for legal expenses if you get sued.

That could be as simple as falling roof tiles or could be a visitor tripping over inside.

Most insurers will include landlord public liability cover as standard, normally at around £2 million and then offer an upgrade to £5 million of cover.

What’s The Best Landlord Insurance DSS tenants?

As with any form of insurance, different DSS landlord insurance policies can vary considerably and while one may be good for one situation it might not be right for another.

For the reasons we’ve outlined above, there are a lot of variables and so you should find the right policy features that you want and then compare prices based on those inclusions.

Don’t forget to shop around regularly as you may find you are able to get discount landlord insurance simply by switching provider now and then, as long as the new insurer offers the right cover for you.

Cheap Landlord Insurance For DSS Tenants

You must be very careful when looking for cheap landlord insurance for DSS tenants as you may miss out on important cover features if you go straight for the cheapest option.

At the same time, however, you don’t want to be paying for extras you don’t need. Do some research and really consider what cover you require.

Landlord rent guarantee insurance is certainly a popular product but often comes with some very strict terms and conditions that might make it difficult to claim. You may also have to perform additional affordability and credit checks on the tenants. That said, with limited rent protections out there for landlords in the law this could be an important consideration if it is right for you.

Watch out for other product perks like accidental damage and ask if they specifically cover actions by tenants. An insurer may offer accidental damage cover as part of a DSS landlord insurance policy but with an exclusion of any damage done by tenants. The same goes for theft as a lot of insurance policies require evidence of forcible entry for a theft claim when a tenant may have keys.