HMO insurance is a form of landlord insurance designed for houses of multiple occupancy.

A house of multiple occupancy specifically means separate households or individuals who are not related to each other and have not rented a property as a single group but still live in the same house.

HMO landlord insurance can cover a variety of separate aspects – buildings, contents and liability.

Table of Contents

Get a HMO Insurance Quote

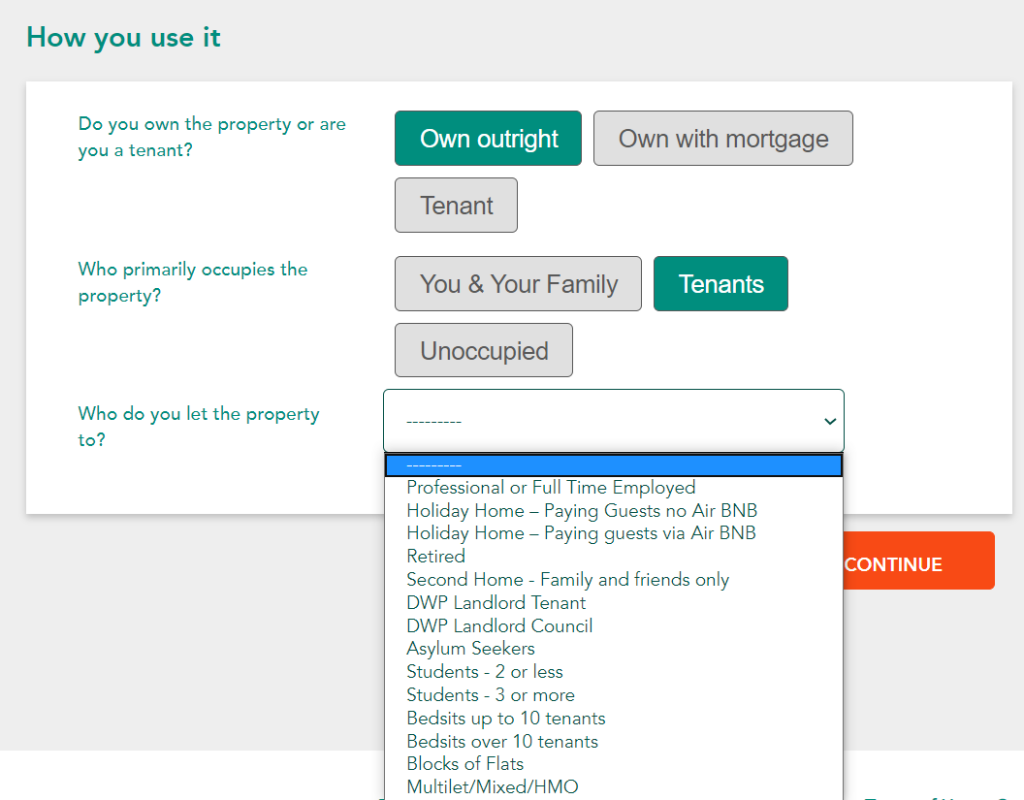

Getting a HMO insurance quote is easy with Emerald Life. You can call us and one of our experienced staff will take you through the process or you can use our fast online quote form.

Fill in the property details as accurately as you can and when you get to the question on “who do you let the property to” you can select “Multilet/Mixed/HMO”.

When you complete the quote and are given the price you should then be able to scroll down and see the HMO endorsement added, which will also show on your policy schedule if you buy.

Types of HMO Insurance

HMO Buildings Insurance

Landlord buildings insurance for HMOs is perhaps the most important part.

In general landlord insurance does not cover the contents of tenants and so it is the buildings cover the landlord may need in case of damage to or the destruction of the building.

Landlord insurance is not a legal requirement for HMOs, or any other property in the UK, but can offer valuable financial protection. If a house of multiple occupation is bought with a mortgage then the mortgage lender may also require appropriate buildings insurance to cover the HMO.

Some councils also require a HMO license and so you should check you are fully compliant.

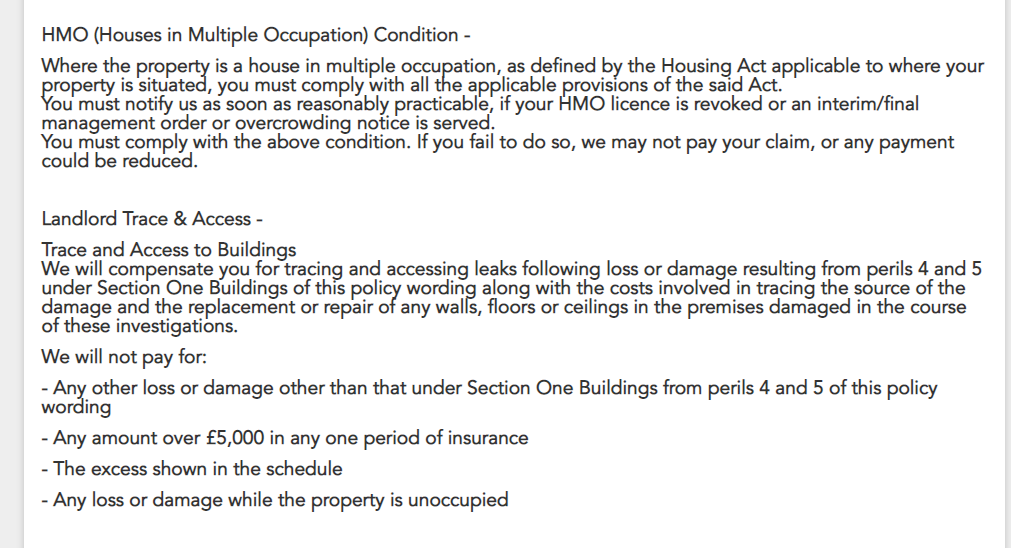

For HMO insurance, the insurers will also often include an extra requirement that the landlord complies with all regulations relating to owning and operating a HMO. This is important because, if a council sues you because you have not complied with the regulations, the insurer is not going to pay out if you are in breach of those regulations. Also, bear in mind that these regulations change frequently and it is your responsibility to be aware of those changes.

But even though HMO buildings cover is not a legal requirement many landlords choose to get it so that in the event of a disaster like fire, flood or malicious damage, their investment in the property is protected up to the rebuild cost of the building. In other words, if the house burnt down it could be reinstated and the insurer would pay for the rebuild cost.

That is one reason why it is important to get the right rebuild cost when applying for landlord insurance. That dictates how much buildings cover you actually receive. If you underinsure then you would have to pay the additional cost to rebuild the house if the worst happened.

Accidents happen normally and with more people in a HMO the risks are unlikely to go down and so many landlords choose HMO insurance to ensure they are protected.

HMO Landlord Contents Insurance

Landlord contents insurance covers items belonging to the landlord at the property. Most landlords don’t tend to leave a lot of value in a property but there could certainly be things like televisions and furniture which a landlord would like to insure.

At Emerald Life we include £5000 of landlord contents cover free with every landlord insurance policy.

However, HMO insurance does not cover tenant’s contents as tenants are responsible for getting their own contents insurance.

You should also note that fixtures such as baths, toilets and sinks are actually covered by buildings insurance so be sure to include that in your calculations as you may not need as much landlord contents cover as you expect.

HMO Landlord Liability Insurance

Landlord liability insurance provides legal cover in the event that someone is harmed by the HMO property.

For instance, a falling roof slate is just one of many ways someone could be injured on your property. This is a feature of standard home insurance as well as landlord insurance, but either way it is important to have some cover should your HMO cause an accident.

At Emerald Life we provide a minimum of £2 million landlord liability insurance as standard, which can also be increased to £5 million.

Other HMO Landlord Insurance Features

HMO insurance includes many of the same features of our landlord insurance. A popular one is landlord rent guarantee insurance.

Rent Guarantee Insurance

our rent guarantee insurance means if your property is made uninhabitable then we will cover the rent lost – which could be important if you are paying a mortage on the property.

Correct Cover

It is important when getting any kind of insurance that you get the right cover for you. With HMOs that can be difficult because not every landlord insurance policy is going to cover HMOs out of the box.

HMOs carry a very different degree of risk. Imagine if you had a flat rented by a couple and a HMO with three couples living in it. You would naturally expect more to go wrong at the HMO.

For that reason you should check your landlord insurance covers HMOs and if they have any specific terms and conditions attached. Are there any exclusions to the policy you need to be aware of? Have they taken the fact you are insuring a HMO into account with the pricing?

Multiple Properties

If you have landlord insurance for multiple properties then a HMO needs to be considered as part of this and covered appropriately.

If you already have a portfolio of properties but then decide to rent out one to multiple households then it becomes a HMO and needs to be covered. You should inform your insurer of the change and consider shopping around if they are unable to cover it or significantly charge more for it.

At Emerald Life we are able to provide a discount on landlord insurance for multiple properties. You can read other ways of getting discount landlord insurance here.

What is HMO Insurance?

HMO insurance is landlord insurance for properties that are classed as houses of multiple occupancy. HMOs are buildings where more than two unrelated people live.

Is HMO Insurance a Legal Requirement

No, but there are lots of benefits to landlord insurance as well as protecting the money you have invested in the building. Buildings insurance is important in case the property is detroyed. However, to be valid your insurer needs to be informed that the property you are insuring is a HMO.

What Does Landlord Insurance Cover?

Besides the reinstatement cost of the building, landlord includes extras like landlord contents cover and property owner’s liability cover.

Can I Get Insurance If My HMO Is Let To Students?

Yes. Some insurers will decline student tenants as they are deemed higher risk. At Emerald Life this is not the case and we cater for all types of tenants.

What If I Have DSS Tenants?

No problem! At Emerald Life we cater for all types of tenants including those on housing benefits.