If you rent out a property then landlord contents insurance might be a good idea.

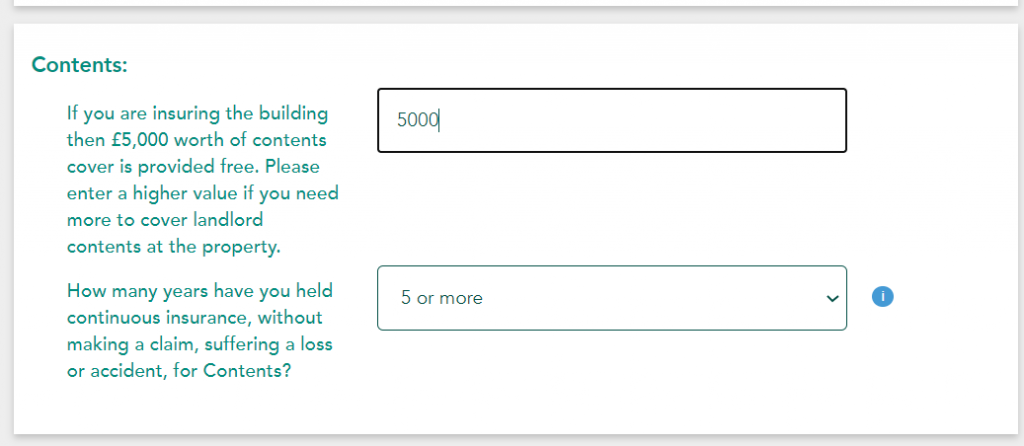

At Emerald Life we provide £5000 of landlord contents insurance free with every landlord policy.

Carpets. Tables. White goods. If you are a landlord there’s a good chance you aren’t just handing your tenants an empty shell, even it’s categorised as unfurnished.

Buy-to-let properties with, for example, core white goods, can be much easier to let with tenants able to move in straight away. That’s especially good for shorter term tenants like students. And carpets or other floor coverings are yours, as well as perhaps a coat rack, occasional mirror, or a couple of chairs.

Add up all these little additions and you probably have quite a significant amount of money lying around your let property. Lots of landlords think about the bricks and mortar but there may be contents that you need to think about too.

Table of Contents

How to Get A Landlord Contents Insurance Quote With Emerald Life

Getting a quote with us is easy. Just go to our fast online quote form and put in your details. On the 4th page you will be given a question on how much contents cover you require – it’s already set at £5000 which is what we give you for free. After that finish the remaining questions and you will get your landlord contents insurance quote.

If you have any problems or queries feel free to call us and get help.

What is Landlord Contents Insurance?

Imagine your let property was destroyed tomorrow. Hopefully you have landlord insurance for the value of the building so it can be reinstated at no extra cost to you.

But what about those things you left in the property? Buildings insurance covers the physical structure of the building as well as fixtures like baths and sinks. But it doesn’t cover things like furniture, washing machines or fridges.

It’s unlikely that you have many contents of particular value in the property, but if you did have to replace even half of them that could still add up to a hefty sum.

As with all financial products, this comes down a lot to your risk tolerance. If you have a buy-to-let mortgage and are covering that with rent payments, then you may not be able to comfortably afford a hit of a few thousand pounds to replace some contents all of a sudden.

On the other hand, if you could destroy all your landlord contents tomorrow and simply order replacements right away then you might not bother with landlord contents insurance.

But why risk it? Most landlord insurance policies include landlord contents cover at little extra cost. In fact, at Emerald Life we provide £5000 of landlord contents cover for free.

What does landlord contents insurance cover?

While contents covered may vary between insurers common landlord contents covered include:

- Light fixtures

- Sheds

- Garden contents

- Furniture

- Kitchen appliances

- Curtains

- Carpets

- Paintings

How much is landlord contents insurance?

Different insurance providers will vary on price considerably. As landlord contents insurance is not normally a very big policy on its own then you may find a lot of providers offer it as an add-on to landlord buildings insurance.

How much that impacts the premium you pay will vary between providers. In general though, landlord contents insurance is fairly low priced because most policies are quite small – insuring a few thousand pounds of contents rather than hundreds of thousands of pounds for the building.

The cost of landlord contents insurance will vary based on a number of factors like:

- the value of contents you are insuring

- the location of the property

- the security of the property

- your excess (how much you commit to contribute towards any claims)

- your claims history

Tenants’ Contents

Landlord contents insurance only covers the landlord’s contents and nothing belonging to the tenants. Therefore, tenants should decide for themselves if they need to get their own contents insurance.

That can be a little confusing because the buildings insurance is the responsibility of the landlord. But tenants are responsible for insuring their own possessions.

Landlord Contents Insurance for Flats

We provide landlord contents cover for all sorts of properties including HMOs and blocks of flats. Landlord contents insurance for flats will often include extra furniture and carpets if you have large communal areas like corridors and a lobby.

Compare Landlord Contents Insurance Quotes

With all inusrance products it is good to shop around to find the best deal. However, make sure you compare apples with apples to make sure you are comparing prices for the same amount of cover.

As part of this you should consider what kinds of insurance you need. For instance, are you getting full landlord insurance with buildings cover or just landlord contents insurance only? Are you interested in extras like accidental damage and home emergency cover? Features like this will decide which insurers will offer you the cover you need and at what cost.

While a lot of these add-ons seem great you should check the policy wordings to see what they actually cover. In particular you should check if these include any harm by tenants – especially for features like accidental damage – which may be excluded.

A good start can be comparison sites. But don’t be fooled. Not every insurer is on a comparison site and often it is bigger firms that can afford to pay referral fees that dominate those pages.

Smaller and more specialised insurers on the other hand may not even be on there, and if they are the price could be different compared to going direct.