Why student landlord insurance? Students are the landlord’s blessing and curse.

You might have been helping out a relative or your own child by buying a property in their university town and letting the remaining rooms. That’s a good way to have an onsite property manager that you can nag if they aren’t pulling their weight!

Or maybe you’re just reaping the investment opportunity of real estate and see the advantages of letting to students: predictable annual tenancies who have got their living expenses already provided months in advance.

On the other hand, the stereotypes of student houses are certainly not confined to The Young Ones and it’s fair to say that students represent a higher risk tenant than a professional couple. However, often there is scope for a rental to a group of students to be more profitable – they often accept less space, and often every room in a flat apart from the kitchen and the bathroom can become a student bedroom.

Looking at it negatively, many insurers see this risk too rather than the benefit and many student landlord insurance policies won’t cover students. However, at Emerald Life we can.

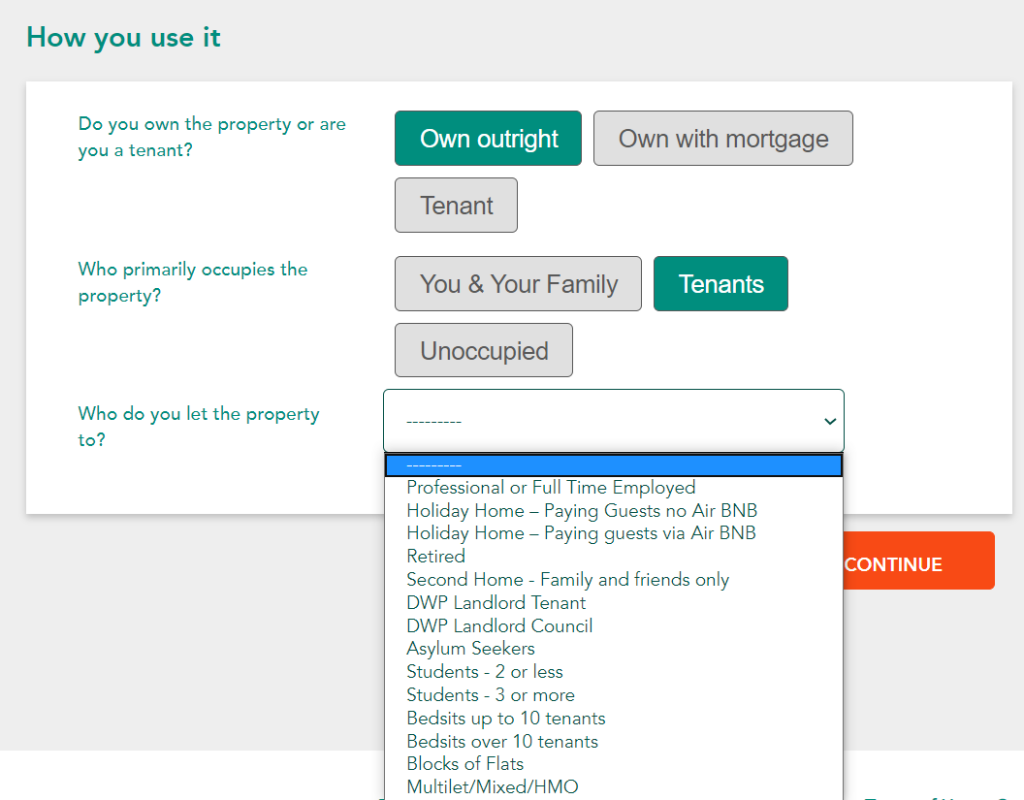

Student landlord insurance is easy. Our underwriters offer cover for many different types of tenants (employed, retired, AirBnB) and students are just one type of tenant – a data point that will have an effect on the premium you pay but hopefully not a drastic one.

For that reason it is worth shopping around student landlord insurance providers because each one is likely to have a different view on students, their risk level and what qualifications the provider will put on their student landlord insurance cover.

Get a quote now and see how much you could save today.

Table of Contents

What About Normal Home Insurance?

Normal buildings insurance is meant to cover your own home (your main or principal residence). If you let out a property then your insurer is unlikely to pay out on claims if you have the wrong type of cover (mainly because you have likely been underpaying for the risks involved). Instead you should consider landlord insurance. This is the appropriate product for let property so that you are covered if something goes wrong.

Landlord insurance often comes with a variety of extra benefits like cover for lost rent if the property is made uninhabitable and landlord contents cover for any contents that you own.

Landlord insurance is not a legal requirement but like normal buildings insurance it is an important protection for your investment in the property in case it is destroyed.

If you are buying a property to let out through a mortgage your lender will probably require you to have buildings insurance to protect their own interest in the property, and they may also want to check that it is the right type of cover – again, get the wrong type of policy and you will be paying an annual premium for zero cover.

Student Landlord Insurance – HMOs

If you are letting to students you may need to consider student landlord insurance for a house of multiple occupation (HMO).

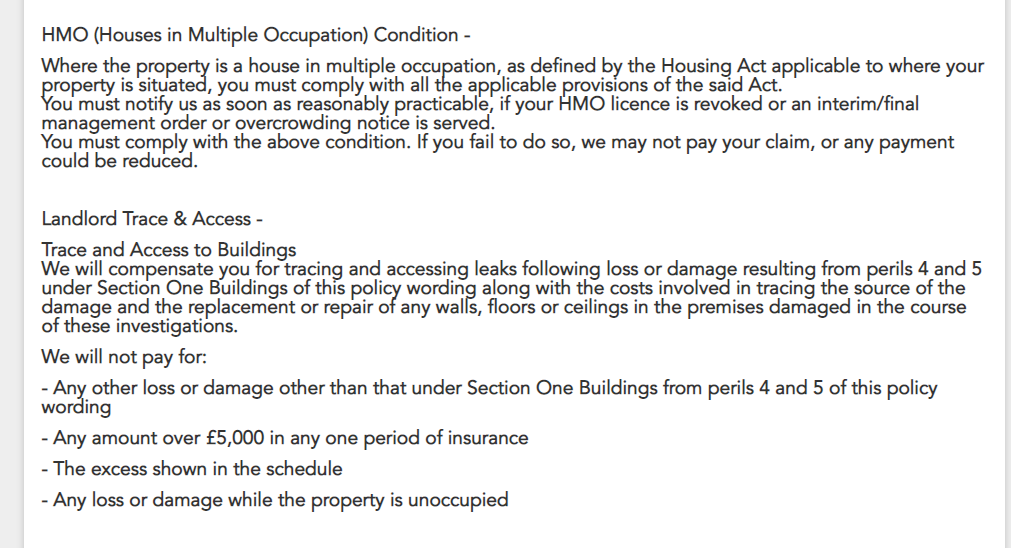

If you are letting to three or more tenants who are not related to each other then you may need to comply with HMO requirements. From an insurance perspective, HMOs are again a slightly different policy.

In either case, at Emerald Life we provide both standard landlord and HMO insurance policies for all types of tenants, including student landlord insurance in both cases.

To buy HMO insurance just go through our fast quote form filling in details as accurately as you can. When you get to the question “who do you let the property to” you should select “Students – 3 or more”

It might seem a little confusing when you see separate options of student tenants and HMO. You should go for the option that’s most appropriate to you and call us if you’re not sure.

However, both “Multilet/Mixed/HMO” and “Students – 3 or more” will result in the same endorsement.

That’s the note on your quote and policy that clarifies this is a HMO. You can see this when you complete your quote and get a price and scroll down.

Unoccupied House Insurance

Students can enjoy very long holidays. Despite very high university fees it is amazing just how short the terms are. If you find your tenants disappear after exams and your property will be left unoccupied for a few months then you may need to consider unoccupied house insurance.

While landlord insurance is fairly comprehensive, the property is still expected to be occupied. If it is unoccupied for more than a few weeks and you have a claim then there is a chance your insurer may refuse your claim if the property was left unoccupied for a long time.

Unoccupied house insurance takes account of the increased risk of an unoccupied property and calculates a premium based on that risk so you are covered correctly if something goes wrong.

But your property is only going to be unoccupied for a few months? No problem. At Emerald Life we offer short term unoccupied house insurance with a minimum of just three months. As for your student landlord insurance policy for the rest of the year we can issue a pro-rata refund depending on how much of the policy remains outstanding and whether you have made any claims in that policy year.

Block Insurance

If you are in need of block of flats insurance for student tenants then again this is no problem. Emerald Life offers block insurance whether you’re the freeholder or part of a resident’s association and includes student tenants.

Block insurance means you are covered appropriately with flats leased or rented out in the same building. This still includes our £5000 of free landlord contents cover which may be relevant for items in communal areas like furniture and carpets.

Location

An arguably bigger influence on insurance premium than student status could actually be just the location of the university. Cities tend to have a much higher crime rate and so come with higher premiums.

A lot of underwriters will also be using ratings tables that are decades old and so may not represent an accurate picture of the area now.

For instance, the University of Manchester is a highly-regarded Russell Group university in what is now a rich and metropolitan city. However, older ratings tables will show certain areas before they became gentrified and so may show a higher crime rate. On the other hand, landlords with students in Durham are probably less likely to have that problem.

Similarly, if your property is a new build then its postcode may not be available in a lot of ratings tables. That is another instance where a committed insurer like Emerald will happily take your call and work out the correct premium for you.

You can see lots more about our types of cover here – but if in doubt just call and one of our call agents will be delighted to assist.

What is student landlord insurance?

Student landlord insurance is landlord insurance that covers you even if you have students as tenants. Some insurers may not cover students because they are deemed higher risk tenants.

My tenants are away for 3 months. What can I do?

With student landlord insurance you may find you only have tenants for some of the year. If your property is unoccupied for a long time we can offer you a short term unoccupide house insurance policy so you are still covered even when people are not living there.

What kind of student landlord insurance policies are there?

The biggest question for you is probably what kind of property you have. If it is a house with one or two tenants then standard landlord insurance should be appropriate. If you have more than two tenants you probably have a HMO and so need HMO insurance. If you own a block of flats with student tenants then consider block of flats insurance.

One of my tenants has graduated – what now?

If some of your student tenants have graduated then that’s great news. We can also provide cover for professionals, unemployed and DSS tenants on the same policy so just let us know via email or phone. You may even find your premium comes down as a result.