Landlord rent guarantee insurance is a popular product that aims to compensate you if your tenant is unable to pay their rent.

Landlord insurance with rent guarantee can come in a variety of different forms and can vary from one insurer to the next – they will all have conditions to it is important to understand the cover levels that you have.

At Emerald Life we offer landlord rent guarantee insurance that covers lost rent if your property is made uninhabitable. So if the property has a flood, burns down or is otherwise made unsafe for a tenant to stay there, you can claim for lost rent.

That’s an important safeguard if you have buy-to-let property with a mortgage so that you can keep paying the mortgage in the event of an incident but you need to balance that against the costs of getting that cover – a real economic replacement for rent in any case can be expensive.

Other Landlord Rent Guarantee Insurance Products

There are some landlord rent guarantee insurance policies which aim to go further than that and offer a safety net if your tenant is unable to pay rent, such as through redundancy.

But while that may seem an amazing catch-call solution, it is worth checking these policies carefully to see their specific terms and conditions.

It is not simply a case of a tenant being made redundant, asking for an extension and then you claiming back what’s missing. Most landlord insurance with rent guarantee requires you to actually evict the tenant in order to pursue a claim which uses up time and money.

As with most insurance you are expected to do everything in your power to resolve the situation and minimise your losses. You will also have to pay an excess, often equivalent to one month’s rent.

Nevertheless a lot of these policies come with the extra perk of cover for your legal costs in the eviction process. That usually aims to get rent back through the courts but note that if a tenant can’t pay you now they won’t be able to pay when the court demands it either. Instead they may be ordered to pay a small contribution that they can afford over a long period of time.

Generally a landlord rent guarantee insurance policy will require your tenant to have passed proof of earnings and affordability, proof of ID and a credit check showing no CCJs in the last three years. If you have DSS or student tenants this may be a concern for you but a lot of policies still offer cover for all types of tenants providing they can satisfy those checks.

As with pretty much all insurance policies, you must not be aware of an incoming problem that may cause a claim before you buy a policy. You obviously cannot take out a policy when a tenant has already defaulted and once you do take out a policy there is usually a 90-day exclusion period before you have cover.

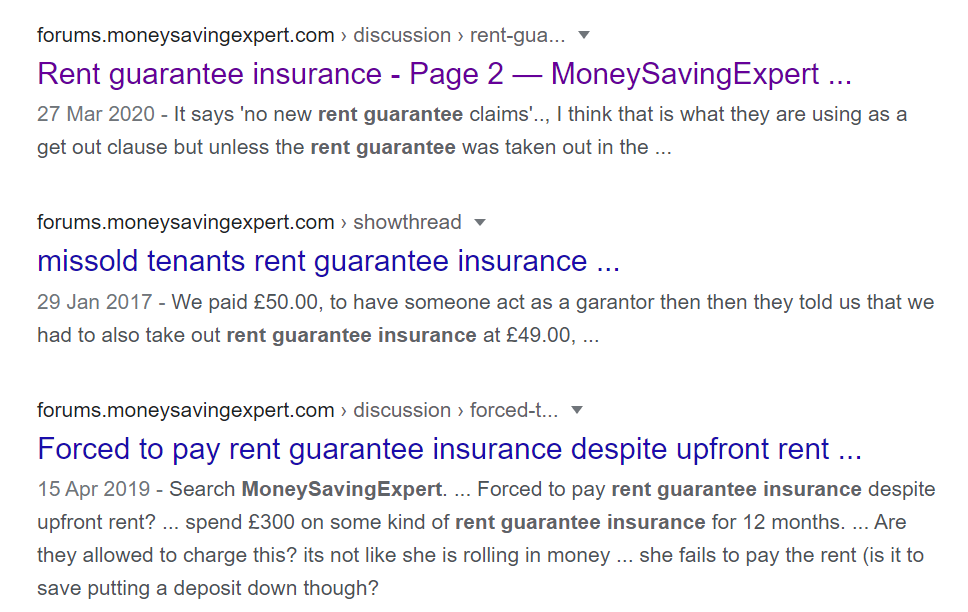

It is important that landlords fully understand the policy they are buying. It doesn’t take much searching to find plenty of examples of landlord rent guarantee insurance that turned out not to be the safety net some people thought.

Is It Worth It?

Of course landlord insurance with rent guarantee is still a good product to have. Many landlords have nightmare stories of tenants who played the system – who were able to wait for each legal requirement to be fulfilled for an eviction and then packed up to leave when removal was imminent. Landlord rent guarantee insurance could be a great help there.

As with every financial product, a lot comes down to your risk tolerance and personal financial situation. Landlord rent guarantee insurance could be a lifesaver in the right situation or just an extra cost and admin task to deal with.

The important thing is that you read the policy wording before you buy and work out exactly what your obligations would be as policyholder and what the policy actually covers.